Written by Zeryn Macklin.

Now that the new year is here, and with tax season just around the corner, many students will begin preparing their tax returns. The 1098-T form is a key part of that process, and this article explains how students can access their 1098-T through MyPack Portal. Knowing this information will allow you to guide students and their parents on this process.

What Is the 1098-T?

The purpose of the 1098-T is to report payments for tuition and qualified student fees during the calendar year and is required for claiming educational tax benefits. Students can expect to find their 1098-T in MyPack Portal on or after January 31.

What Students Need to Know

The information on the 1098-T is the data the university is required to report to the Internal Revenue Service. Keep in mind that the form only includes payments made toward tuition and qualified fees — it does not reflect payments for housing, dining, Greek life or other non-qualified charges.

Additionally, in compliance with IRS guidelines, students must provide their Social Security Number (SSN) to NC State. This can be done by navigating to the Personal Information tile in the MyPack Portal.

Please keep in mind that, while the form may be essential for tax purposes, the University Cashier’s Office cannot provide tax advice. Questions about how this information impacts a tax return should be addressed with a tax professional.

How Can Students Access the 1098-T?

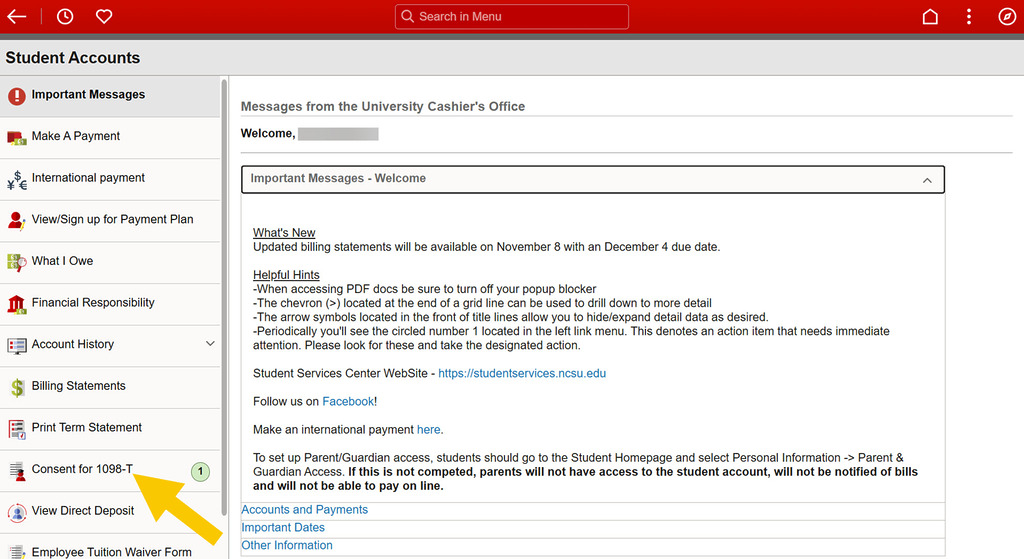

- Log into MyPack Portal.

- Navigate to the Student Homepage.

- Click on the Student Accounts tile.

- In the left-hand menu, click on Consent for 1098-T if consent hasn’t already been provided. If it has, click on View 1098-T.

- Use the toggle button to acknowledge the consent agreement and click on Submit.

- An email notification will be issued to the email of record once the 1098-T is available.

Can Parents and Guardians Access the 1098-T?

Yes, parents and guardians can also access a student’s 1098-T by logging into MyPack Portal with their Brickyard Login for NC State Parents/Guests and following the same steps outlined above.

For more details on educational tax credits, refer to the IRS Guidelines for Education Credits or reach out to a tax professional. The university also offers free tax preparation services through the Poole College of Management for students and university employees.